When does buying stock on dip can go wrong? How do you know the fall in price is just temporary or it is bearish trend reversal and continue for years?

Most people want to become traders in the stock market. But when they get trapped in a bull market, they like to be an investor. Most people like to participate in it when the market is high. And when they wish to become an investor from a trader in the bull market, this decision becomes more expensive than anything. People buy overvalued stocks in the high market. But when they bought the stock, they were bought to sell at a higher rate. when the market comes down, they decide to be an investor. And the same thing is enough to keep their money stuck in the market for a long time when it comes down for a long time.

When does buying stock on dip can go wrong?

This has happened to a lot of people, Many shares are bought by dreaming of the future. And when they come face to reality, their broken dreams are reflected in the stock prices. There are some points that tell you when stock on dip goes wrong.

When you buy a stock in bull market

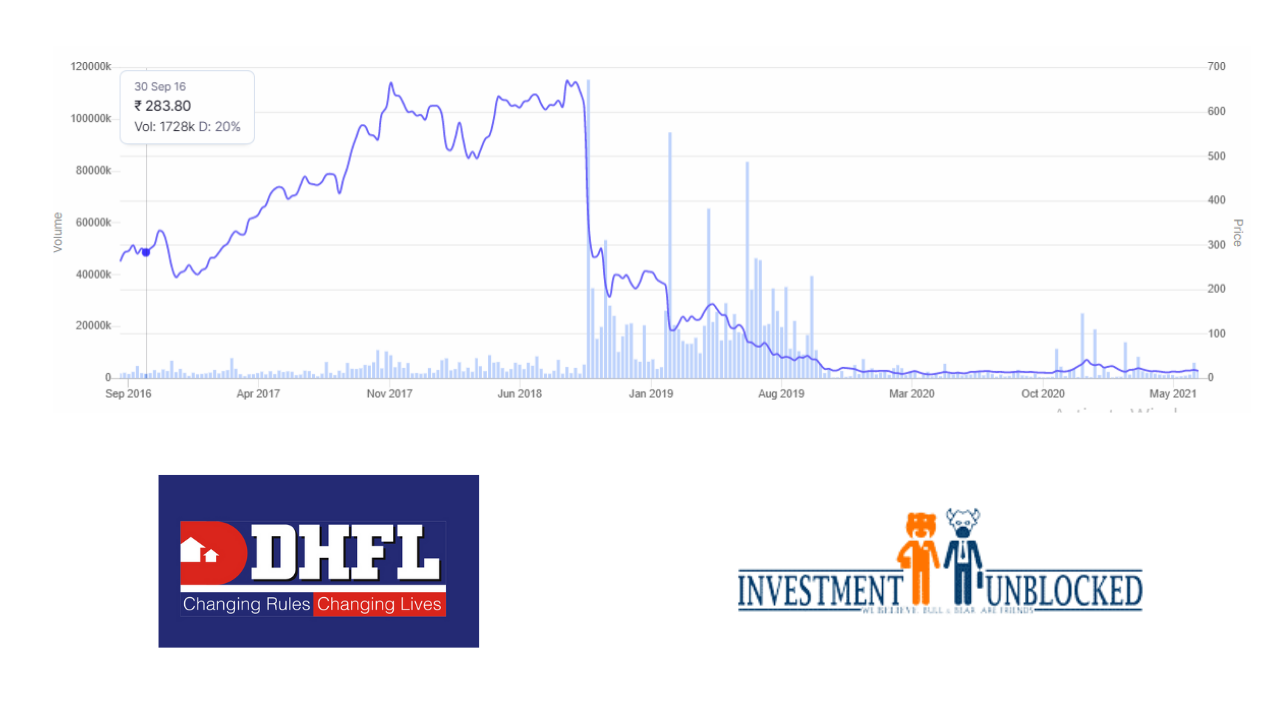

DHFL:- That’s Before the Market Collapse Happened in 2018 investors and traders are daydreaming about DHFL company share price. Earlier in 2016, this stock used to trade at about 130. But in the 2018 bull market, it took the share price to 670 labels. And you know that gravity works well in the stock market if anything wrong happens in a fundamental company. Now DHFL shares are trading around 16 rupees.

Learning 1

Above example, we learn that avoid bull market to pick stocks for the long-term. Maximum times it goes wrong.

When fundamentals are week

Whenever you buy a stock, don’t forget to pay attention to the fundamentals. Always remember price follows fundamentals. No matter how good the news is, if the financials of the company are not good then the price will not last long. Here is a good example of this is Yes Bank.

here as soon as the changes started coming in the company’s financials. share price comes to 12 from 230.

Learning 2 :-

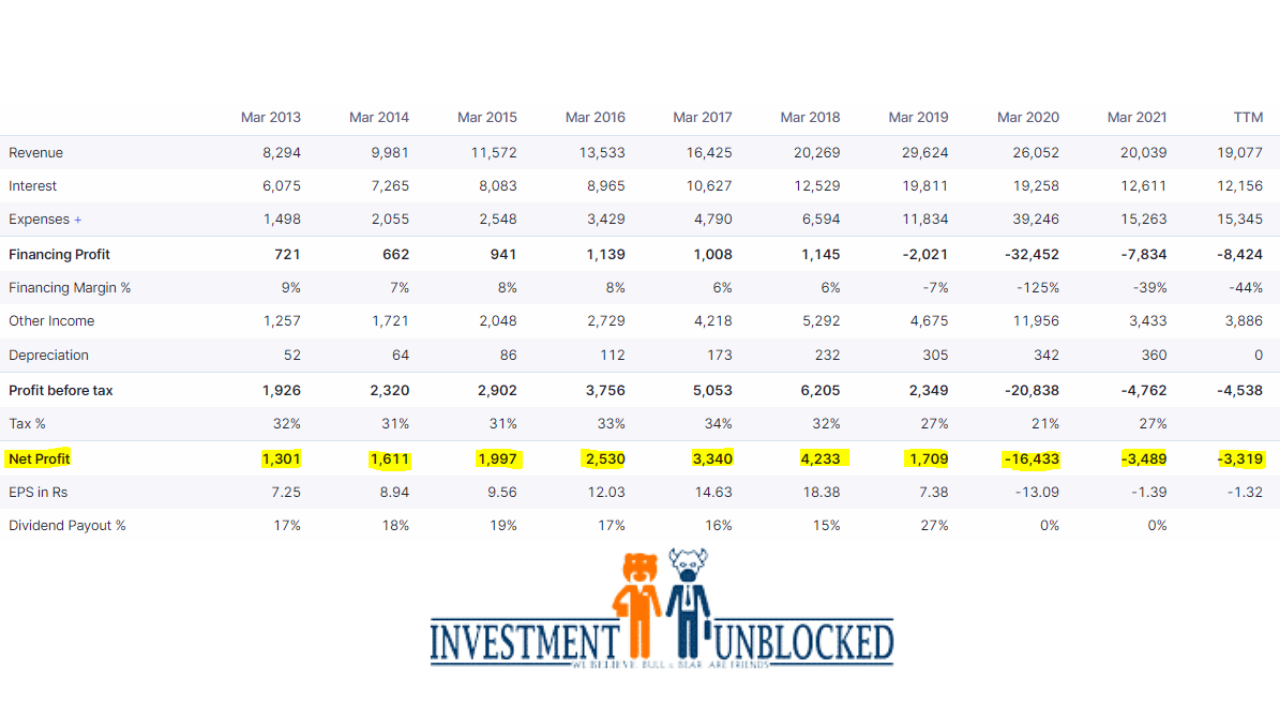

NO matter how good a company is if you see that company making losses continuously. And there is no chance of recovery. Forget about buying in every dip. You will lose all your capital. sell it as soon as possible.

How do you know the fall in price is just temporary or it is bearish trend reversal and continue for years?

Yes, this is the actual question. I have read the answers of some people, who are giving you an indication about the bad condition of the upcoming company in the technical chart. And he explained so well that he seems to be very convincing. People are also upvoting them. But question yourself, do you ever seen an investor who does an investment by analyzing the chart? When the question comes for long-term, or buy in every dip, then everyone should do stock selection by looking at the fundamentals only.

When you are able to analyze the quality of management

Investors’ money gets trapped in both companies above. Stock prices came down after they shared their poor financial performance. If you compare the price chart with historical net profit data, then you will see prices go down before financial data revile. Is it possible that we can get a hint before companies’ financial data get poorer? Yes, it is possible.

Believe it or not, good management can turn a loss-making company into a profit-making company. Similarly, the opposite also happens. So buy in every dip only you should do it in that company when there is good management behind it.

Learning 3:-

I suggest you not pick the stock in the bull market above. Because here the chances are you will get stock very expensive. Here we learned Bargen a stock before you buy it. It is only 1% of picking a good stock. In the next point, we learned we should learn to read fundamentals. Like financials. Because price follows financials. But if management is doing something wrong then you will never get a good financial deal. So the business structure and good finance play a 9% role in picking a good stock.

Now the time for rest is 90%. You will be surprised when you get to know that it’s the management quality that fundmangers are searching for. These three aspects are very important. You have to buy stock in Bargain (Under intrinsic value), have to select a good business with good financial condition. But management plays the role of a pilot of a company. But it is not that easy to analyze company management. It needs a lot of experience. We have already discussed how to analyze management in another blog. Click on the link and know “is it a bearish trend reversal and continue for years?”

thank you,

regards,