What does the P/E ratio tell about a stock? If a stock is at 97 P/e, is it too expensive?

PE Ratio does not tell you the valuation of the stock, but it tells you whether the stock is cheap or expensive. And if any stock is trading at 97 PE then it can be expensive, but we can’t say that it is overvalued or not. Let us understand this thing with different scenarios.

HIgh PE undervalued (economical) stock

PE is high only when the price is very high, or the company’s earnings are very low. Now the question is why is the price high? There can be many answers to this. But if we see more general then there are two things which make stock high PE. 1. Either there is some good news in stock. 2. Or else the good earnings of this company have come.

If price increases because of growing earnings then there is less chance of high PE. because we all know that PE is calculated by price divided by earnings. There will be a chance that people are purchasing that stock irrationally and stock prices getting more expensive. Even if you are buying this stock in high PE, then its future earnings will work on it. PE will come down to the same price. Or even after increasing the price.

Here is an example:-

You can see here stock is trading at 74 PE. It looks expensive. Why are investors ready to give this much premium to this company? Look at ROCE and ROE is very attractive. Is giving the message that this company can earn more profit in the coming quarters. Which will help in increasing EPS, and automatically reduce the PE ratio.

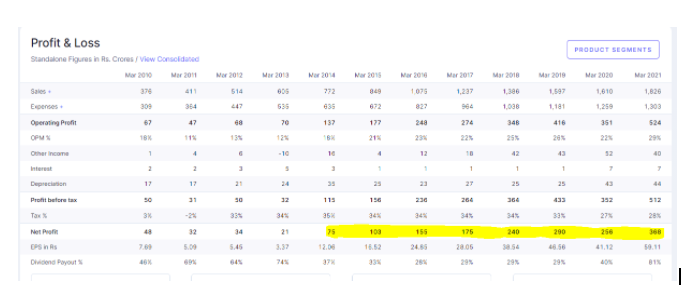

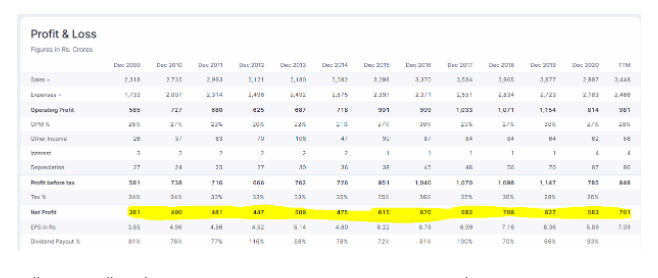

Look at the net profit of this company. It’s growing like anything. And it is growth that attracts investors to this company. Along with this, the company belongs to a very premium and future predictable growth company.

This type of mindset is called growth Investing in the investment world. They consider forwarded PE which is calculated by upcoming earnings according to past growth. Generally, this kind of investment investors does in growth sectors. Where investors are very optimistic about the sector and company.

Another example is automobile stocks. This sector always trades in high PE when the economy performs undervalued. The reason behind this is the decline in its sales. Which impacts its EPS. Due to this reason, these stocks are traded at high PE due to the economic slowdown and this is the right time to invest in them.

Low PE undervalued (Expensive) stocks

Just like high PE is not always expensive, exactly the same way low PE stocks are not always economical. Sometimes it seems expensive. In this current bull market, there are many stocks that are threading at low PE. but still, people are not interested. Because these stocks are expensive. So let’s know some stocks. And we also know the reason behind why people are finding it expensive.

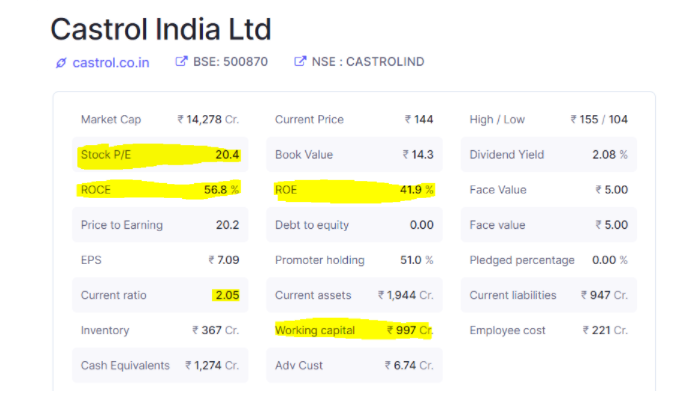

Look at this stock PE around 20, ROCE and ROE 56% and 41% respectively, working capital 997 cr which is a good thing. In this stock, you rarely find any kind of financial unbalance. Now, look at its income statement.

Still in this bull market, no one is interested in investing in this stock. Why is it happening? The people are not able to see the future of this company. To whom will this company sell engine oil when the electrical vehicles come out? In the illusion of the future, people buy and sell the present stock. And this is what people call the Future Forecast. For this reason, people are not investing in this stock even though it is traded at low PE. That’s why this stock is very expensive.

Conclusion:-

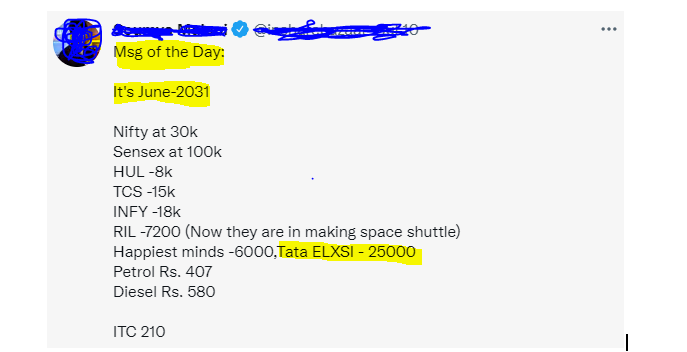

There are two types of investors in the market. One is a growth investor, and the other is a value investor. And in the investing world, the crowd always gathers in the growth investing side. And why not, it seems very optimistic when we look after the financials of these companies. But if you look at the history, we have always got more profit in value investment. But buying a business in bad times is not a matter for everyone. This is the reason. The stock in high PE is cheap, and the stock in low PE is expensive. A living example of this is a tweet and that too of a stock market celebrity. He has given some stocks which the stock price forecast for after 10 years.

And in this, he is mentioned in the future optimistic view on Tata ELXSI. Which is trading above 70 PE.

So I personally think that here your question is incomplete, you have to mention which company shares and from which industry. After that one can say whether it is expensive or not looking after global financial circumstances.

Thank You.