Nifty prediction for Monday / Nifty Prediction For Next Week

There is a lot of rush in the market, the atmosphere is very amazing. Good news is being taken up by the market by avoiding bad news. You can find a 5 point discount on the September future contract. But in November and December futures are trading at a good premium. A lot of people asked me this Saturday, Market Kya lagta hai ?. That is why I am writing this blog. Instead of predicting the market, the intention was to present the whole sector to educate every investor and trader.

Nifty Analysis :-

The market made a good move on Friday 24th September. September 30 futures are trading at a discount, people are confused here. Is it a resistance zone? The Nifty index has been trading in an upward channel for many days. If you look closely it made a shooting star pattern at the resistance level. The Nifty somehow managed to close at 17853. Is it an indication of a market correction?

Bank Nifty Index :-

Somehow we found the same bull run in bank nifty also. Here the candle chart makes a pattern of ascending triangles. But here the trend is too strong so we can forecast that the resistance will not be able to stop the trend. Here also price makes a shooting star pattern at the resistance level. Friday bank nifty closed at 37830. If it breaks the pattern we can go with the buy position.

Midcap Nifty Analysis :-

Midcap nifty also trades in-between channels. Now it is close to the top of the channel at the resistance level. It ended with a bearish log body candle. If you consider two days’ movement then you realize it’s a bearish engulfing candle pattern. Here is a chance for a correction in the midcap index. Will Midcap Nifty be able to maintain the 25000 level ?

Nifty IT Index :-

Here is the reason behind this bull run. Look at it, after breaking a flat rising wedge index breakout at 27500 levels and it makes a continued rally towards 36000. Around 20 k points in 4 months. This is how the bull market works. But Friday after making a new high it makes gravestone Doji at the above resistance level of the sharp rising wedge. It’s a bearish signal. Dojis are always confusing. So let’s see what will happen on Monday morning.

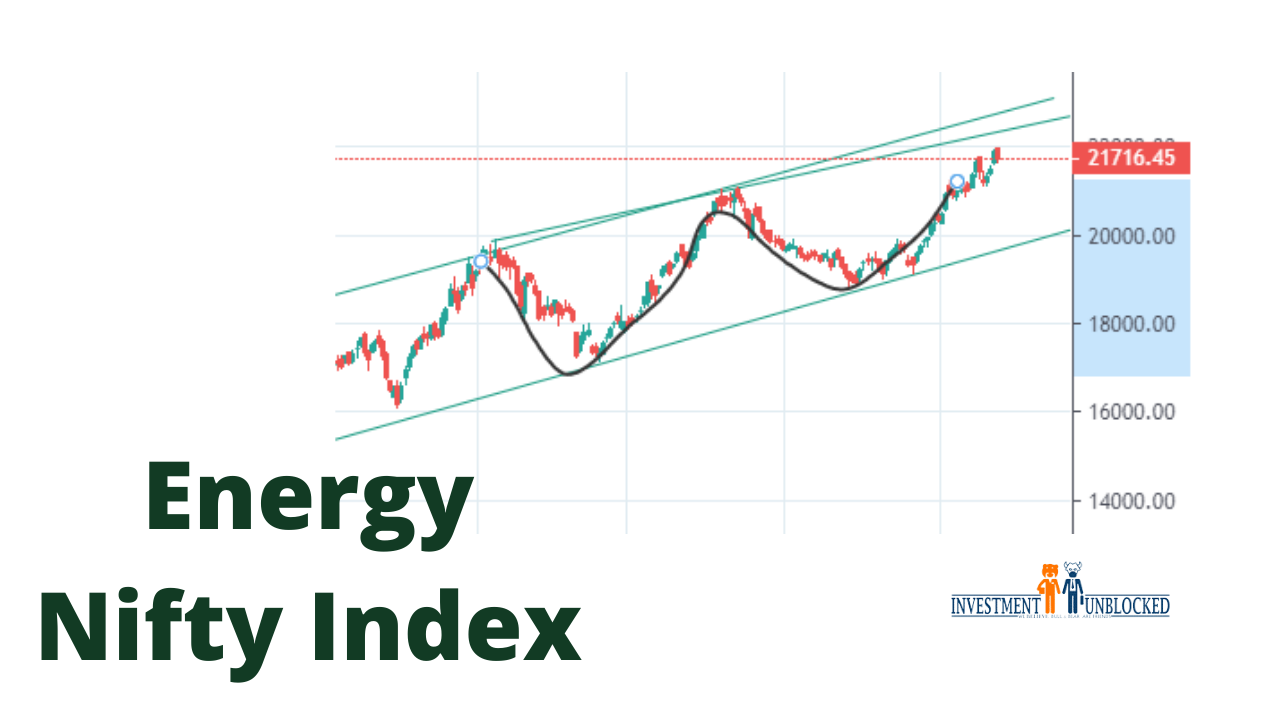

Nifty Energy Index :-

We saw an up and down movement in the energy sector from the last few weeks. Somehow it trades in between a channel, but it gives a chance to book profit and buying opportunities. Now it is going to make a W pattern. If it is able to break a neckline we can see a big bull run in this sectoral index. Here the major support will be 21600.

NIfty Infra Index :-

Nifty infra not able to close above 5000. It is also at a lifetime high. A sharp bull runs after a consolidation period. Ended with a highly reliable bearish candle. Which indicates that it will go down. If it breaks 4964 then it will come down to 5855 very soon.

Nifty Realty Index:-

After breaking the channel it makes 4 bullish candles continuously. Somehow it is not a very big sector in our market, but able to give a very good return in the last 4 days. But it makes bearish candle partners at closing Friday. So there is also a chance for corrections on Monday.

Here in this blog we are providing our analysis for education and trying to help new traders and investors to get a broad pitcher of the Indian stock market. to Invest like a pro please do read our blog Learning From Financial Gurus. if you like this blog please do share and subscribe.