Fundamental indicators to forecast Market direction from here

Whenever it comes to market prediction, every person gets a different prediction in their opinion. It is only because of this, people set time along with their market prediction as per their convenient forecast and information they do have. But if I give people a time target, then most of the views will match. For example, in few seminars, I have asked people, which way can the market run? Some people said the bear, some people said bull. After that, I changed the question a little bit and asked, Which way can the market run in one year? And the result matched the opinion of about 80 percent of the people. And as soon as I changed my question, I got to see more people match the opinion. I have set some parameters for the prediction of the Indian market. Some of them are fundamental indicators, and some work fundamentally in spite of being technical indicators. So, let’s know what that is all about, and how it works.

1. Commodities-:

Commodities are very indicative for predicting the stock market. But there is a problem. When I talk about commodities, people start thinking about trading commodities only.

Whenever there is any change in this. The market gets in a new direction. There are a lot of commodities which is not traded in the market. But all of them are like raw materials for production. So we can use it as an indicator to predict the market.

Chemicals-:

The chemical industry is a very big raw material provider in our country. Famous big companies of India and some are representing nifty 50 index market cap.

They are big customers of this industry. So, we will definitely look after such a large sector.

Crude: –

Crude oil is very important in the stock market, It is a very good indicator for market prediction. Its direction always remains opposed to the market. There are many industries which depending on this, like Paints,

Adhesives, Packaging and Logistics. I do not know whether you paid attention to this price or not, crude oil price rise 108.5% YoY. And its impact will be found in the company’s net profit. If transport and logistic company saw a decline in their profit, then they will definitely increase their tariff. The effect of which the entire market will have to suffer. In the month of May last year, crude oil is seen trading between 1350 Rs and 2500 Rs in a month. But in May this year, the price trading at 4800.

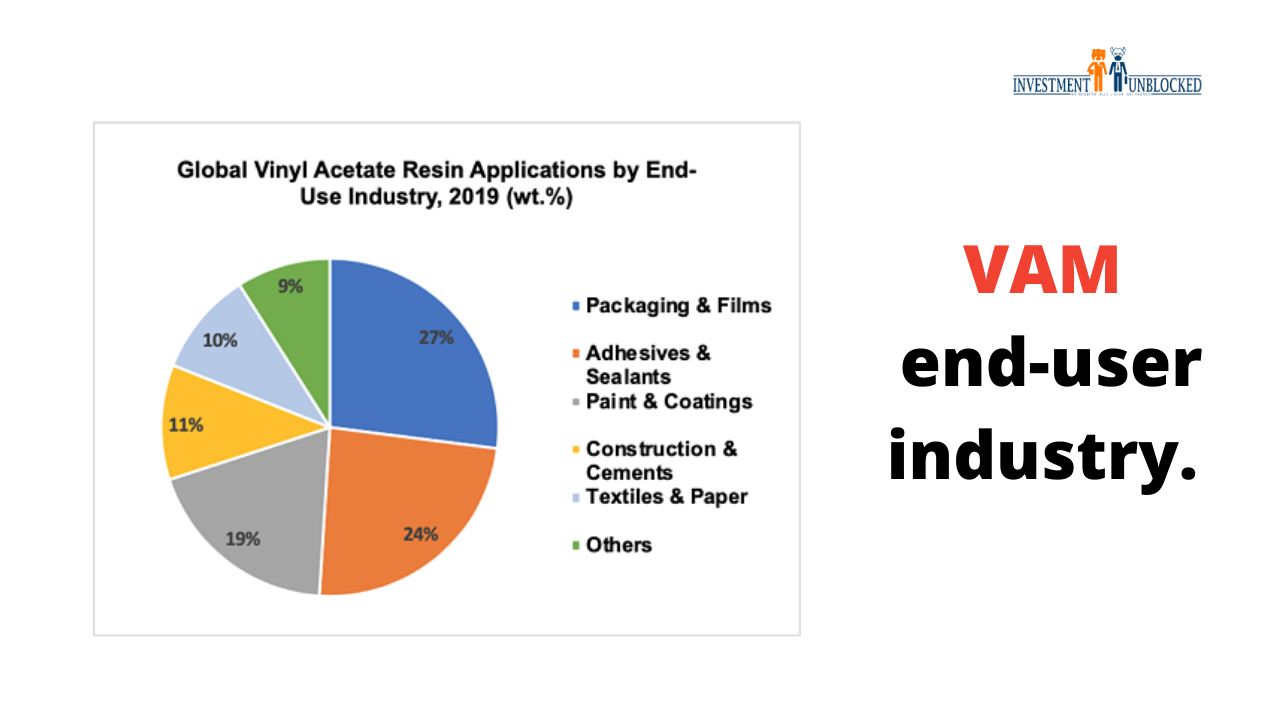

VAM prices (Vinyl acetate monomer)

Not many people know this raw material. This is B2B used the intermediate product.

Vinyl acetate monomer VAM used to make polymers and resins for adhesives, coatings, paints, films, textiles, and other end products. This price jumped by 186.3% YoY. Hopefully, you will see a decrease in profits in paints company, domestic and packing company in the coming quarters.

Liquid Paraffin-

It is used by a hair oil company. Got to see the uptrend in the price of this too. 29.0% YoY increased.

Agri Commodity-:

We are talking about the direction of the Indian market. And unless we talk about Agri commodities, the direction of the Indian market is incomplete.

Barley Spot-:

Barley Spot has also got to see an increase of 24.3% YoY. It used in beer. The alcohol company will force you to increase your prices. They would also have to see the face of loss in the coming result.

Palm oil-:

Wheat, cashew, Sugar was not found to see a great edge in all these. But we have got to see a lot of speed in Palm Oil price. Most of the food brewing companies are mostly dependent on it.

Palm oil prices increased by 89.6% YoY. In the coming period, Britannia, Marico will not be able to give good profit in their quarterly result.

Due to this commodity price increase, we can clearly predict that major FMCG companies not able to present you good profit in the coming period. We expect a downtrend in this sector.

In the next blog, we will take FII, DII, and promoter activity indicators to forecast our Indian market.