Can we invest in Idea shares now? Is Vodafone idea a good stock to buy for long term ?

If it is a matter of buying, then we can buy everything, which thing is ready to sell. But do we buy all the things which are ready for sale? That’s how this stock is trading at a very low price. This does not mean that it is being traded undervalue. Here, buying cheaply is not considered an investment, but buying undervalue does.

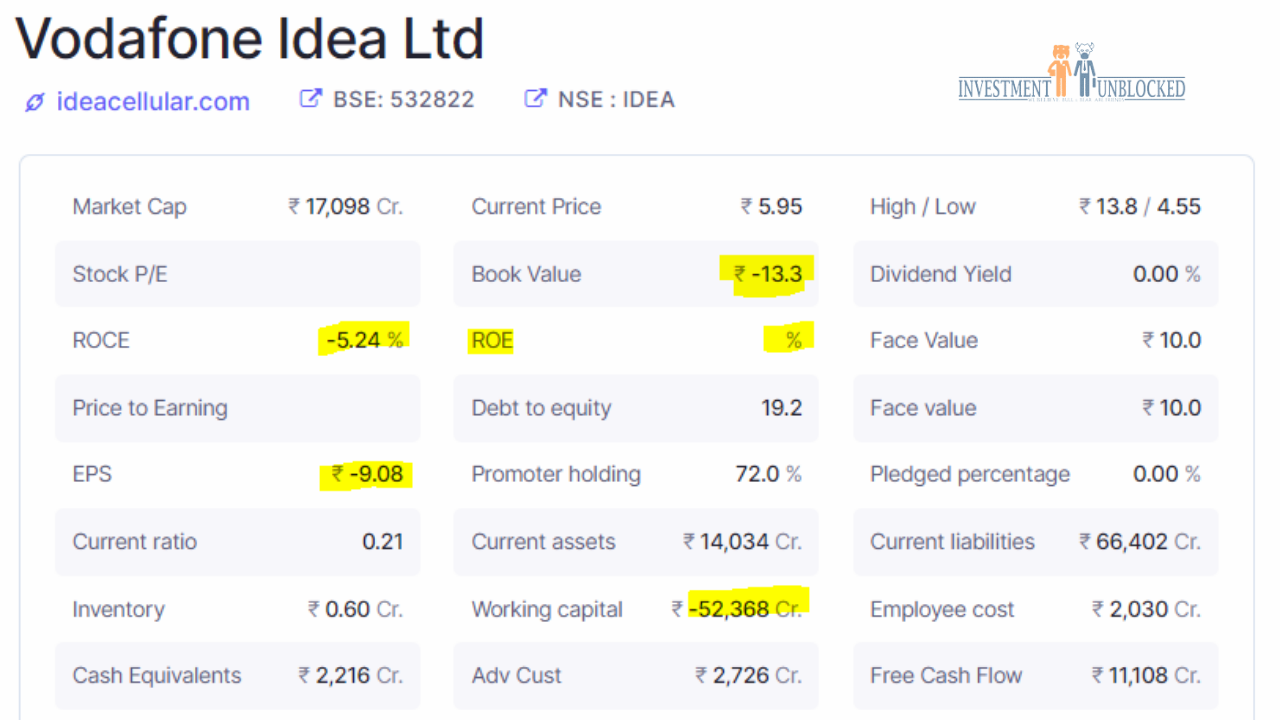

Whenever we buy shares, we should know how much money the company is making behind that price which we paid. Which is visible from the EPS. along with this ROI and ROCE also plays a very important role. Where ROI tells you the percentage of returns from the company’s investments, ROCE tells you the company returns from capital investment.

Personally, I always use these stock parameters where EPS is above 10 to 15 percent of the price which I would pay. I prefer stocks having more than 20 ROI and ROCE.

Now let analyze the IDEA stock

From the above explanation, we got to know what are the basic things we should look at before buying a stock. Here we will consider the same thing in Idea stock.

When we buy a stock, we buy its ownership. Being entitled to its profits and losses also becomes the owner of the accumulated capital and loans of the organization. Here ROCE – 5.24% and look ar ROI is nil. Here EPS is the biggest reason to buy or not to buy stock. That is also negative 9.08%. The most and very important thing is debt to equity which stands at in19.2. For your information, a good fund manager never likes to buy a stock above 1.5 debt to equity ratio.

Peter Lynch Categories of Stocks:-

If we consider the Peter Lynch stock category, this stock will turn around. There are 5 more types of categories. What Are The Classification Of Stocks Explain Each. Turnaround used to be those companies that are hammered by the market. And because of his bad financial statement, that stock is not able to increase. This stock looks very expensive despite being traded at very low prices. If Management has turned this company into a profit-making company, then a lot of money would be made for investors. but it rarely happens.

Example :-

Vodafone Idea, Yes Bank, DHFL, etc.

Conclusion :-

It is very risky to buy stocks in this financial world even though it is part of a very large company. There is a chance of drowning all the money by investing in these kinds of companies. Be careful and before buying these stocks, you must consult your advisor.