What are the advantages of investing in a stock market?

I am a passionate investor. Along with the investment, I also teach investment to people. There are several advantages to investing in the stock market. You will be surprised to know that, in the long term. the maximum returns you get from the stock market, then from investing in other assets.

For the last 10 years, I have been participating in the stock market. I provide services regarding the capital market, sometimes I have picked good or bad stocks in investing myself, sometimes I have conducted seminars to educate many investors to protect their investment in the stock market.

Capital appreciation in stock market:-

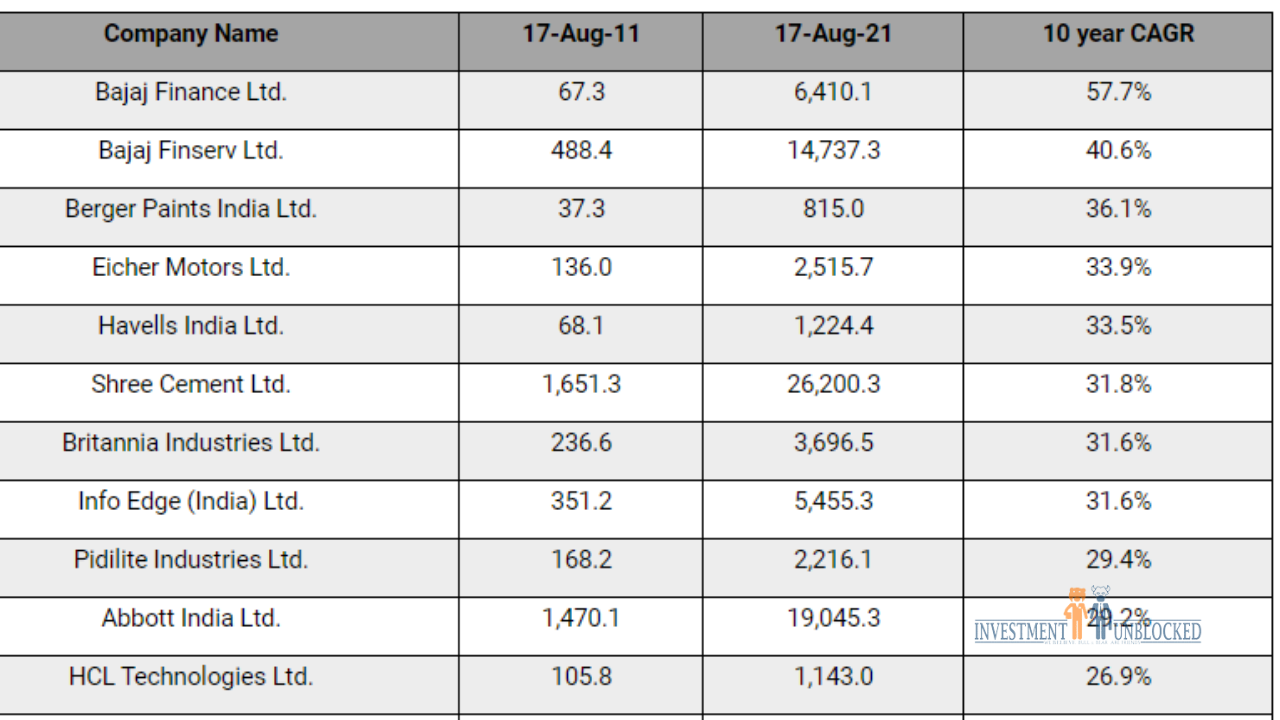

A huge crowd is attracted to the market when a bubble happens. People come after watching historical returns of the market and individual stocks. If you do it correctly, you can make very huge wealth here. Some stocks have made a lot of money for investors but other assets have not been able to give half return of this. Here are some stocks mentioned in the image below, where you can see the top CAGR (Compound annual growth rate)return of the last decade. If you compare it with gold. Gold has generated 10% of CAGR in the last 30 years.

High liquidity investment options:-

If we look after all assets, we think the best liquidation option is Gold. But it’s not that true as per some circumstances. But we found stock has also high liquidated like gold. Liquidity means one thinks about how much it can easily convert to cash. This is the reason why everyone loves gold so much. You can sell your stock during market hours. Dew to a lot of participants, you will be able to find your price as per stock value.

Tax Exemption for investment in shares India:-

like a small hole sinks a boat. Just like that, taxes can be a big hindrance to your wealth creation. Of all the other assets, you get the least tax in the long term in stock investments. The best cream part of stock investing is “DIvidend”. Here you don’t have to pay taxes on dividend income.

Stock volatility advantage:-

Volatility may be fearful for some. But who understands the asset behind the volatility, he is never ever fearful towards it. Even he loves volatility. He buys the asset when it is available at the lowest price. And sell it when it’s at a high price. You can do this in two ways in the stock market. One by investing in the stock market, another way to trade in this. But both of these require a lot of discipline and skill. But thank god Investment Unblocked teaches both the skill to the new and old investor from many years. For trading, they have a Technical Analysis course, for the investment they have a Fundamental Analysis course at an affordable price.

Minimum amount to invest in stock market in india:-

Gold and real estate, you have seen also good returns are made. But have you ever thought that we can’t buy this thing in such a small amount? Imagine you have 500 rupees. With this, you want to invest. I don’t think you can put it anywhere other than in a savings bank account. But you can invest it in the stock market. Right now the share price of South Indian Bank is around Rs 9.30. In this small amount, you can buy about 50 shares for investment. In 2018 this share price used to trade around 32 rupees. If it goes again, then your investment can be usually 3 times. It’s just an example for educational purposes. Not a stock recommendation.

Lowest Transaction cost:-

I am comparing stock with Gold and real estate because people consider it to be the best investment product. There are charges in gold, which you have to pay for buying and deducting on selling. In land and property also, a lot of fees are taken by the government name of stamp duty. Even after that, you pay property tax every year. But in stock, you pay twice tax and broker commission when you buy and sell. This is a very little amount as compared to gold and property.

Nice overview sir

Good portfolio to invest in long term