How to analyse management of a company ?

No new investor ever asks this question. Those who have spent years in the market and have experienced everything in their journey of stock market profit or loss booking, they finally stop by coming to this question. Now they understand, whatever the company’s stocks price run in the bull market, they were good management companies. We experienced that when a company consistently generates high profits for many years, we get to see high growth in the share price of that company. That’s why we have come to the conclusion that how we can analyze the management.

Here are some effective analyses that will help you to determine whether the company will run smoothly in the future.

learnings from history:-

If you do a comparison between stock prices and management decisions then you will get to unblock the management qualities. Whatever fundamentals and financial changes you see in the company, it was once the detection of management. You can read the annual reports to get this information. In annual reports, you will get all the information of past management decisions in the management reports section.

Learning From Books:-

There are many books that are very helpful to analyze the quality of management and forecast it. Sometimes economic slowdown becomes a reason behind a bad result of good quality of companies. In the same way, bad companies also produce good results in good economic conditions.

Due to this reason, many investor’s money gets stuck. The shares of the good company are also sold out of fear. To save yourself from this, you must read these two books. The little book of a Stock market cycle, and one up on wall street. Both these books will tell you about the past crises and bull run of the market. It will introduce you to every situation in the market that was hpens once. After reading this book, whenever the circumstances change in the market, then you will be able to make the right decision.

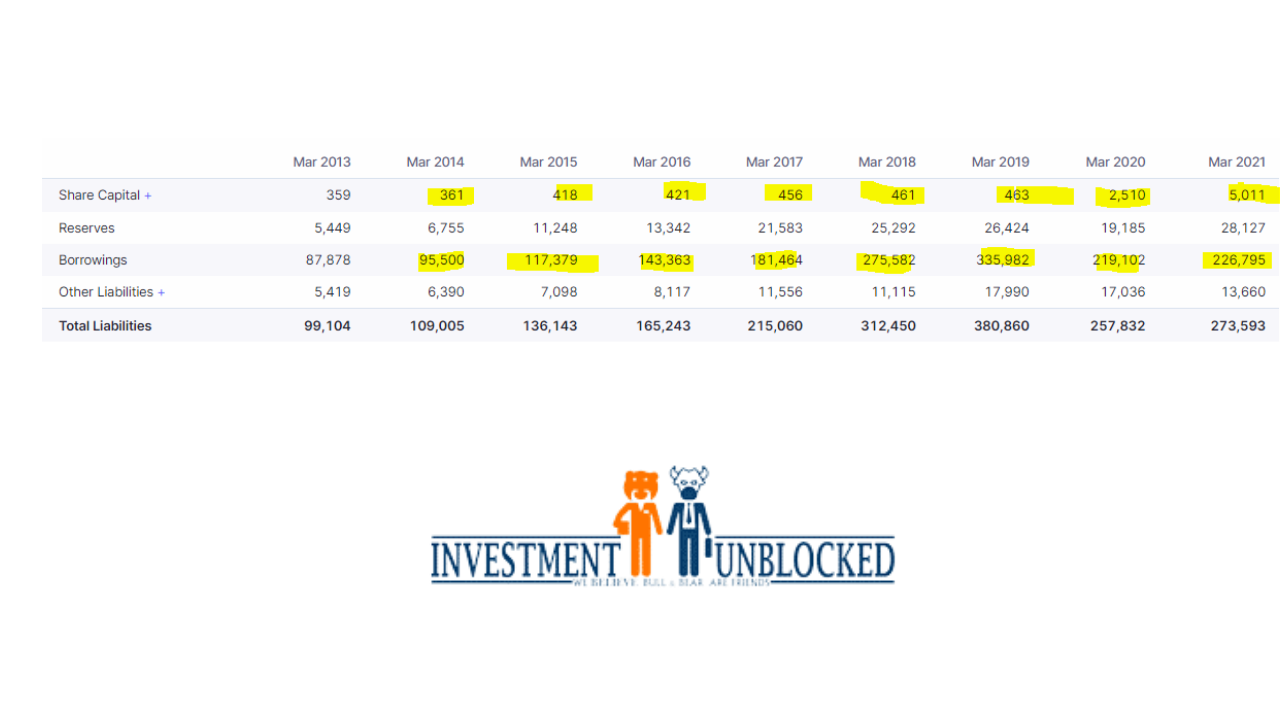

Management Forecast form balance sheet

Here is the way I am looking at the first thing in a good company’s balance sheet. The share capital dilution. If you look closely, you will be able to see that when the company dilutes its share for capital, that is the first step towards self-destruction. Look at the below image, here is the Yes bank balance sheet. Where you can clearly point out that share capital is diluted since 2014 and continues. This is not a good sign. After that, the share price increased a lot but it will not sustain on that label forever.

Another point is to look at their borrowings, it’s increasing like anything. This is a bad sign of a company’s financials.

We are teaching fundamental analysis at a very affordable price online. You can register yourself by clicking on the likin mentioned. www.investmentunblocked.com

Thank you

Regards,

S Prasad Rao.