Should I buy Zomato share ? Is Zomato IPO a good option long term? Should I invest in Zomato IPO.

Nowadays investors are investing in IPOs. Like the Zomato listing that happened today. People are very happy about who got this IPO. But those who did not get it bought after listing. And now there are some people who are wondering whether it will be right to buy at this price or not?

Irrational Investor Behavior

Everyone in this market believes that investors are irrational. There are two main reasons for participating in this IPO. You have to decide whether the angle is right or wrong. Maybe you’re also in one. If you are one then, this will give you a chance to rectify your mistake. Let’s know those two types of people who are participating in this IPO after listing.

Speculators :-

If you are in this category or you want to be one of them. Then you should know that speculators are always doing chart analysis. 1. speculator by analyzing the stock chart. And this stock was listed yesterday, so you don’t have enough data. So you can’t make any technical detection on it. And yes there are some people who trade for companies by events or news. 2 . speculator by event trading. But believe me, it is very dangerous and it takes years of experience to make a profit at the right time. and book the losses at the minimum stage. The best example of this is Reliance Power. They had IPO lunch at their best time. The price band in this IPO was 405 to 450, and the lot size was 15. In this IPO many people lost their money.

If you do not come under the above two categories. So you can be an irrational trader. These people also make money, but in this phase of the market only, they lose all their profit and principal amount in the other 2 phases. Which is the long last in the stock market cycle.

Investor :-

There are also two types of investment worlds. One is the one who buys expensive shares by seeing the growth potential of the companies in the coming future. And whatever other company’s growth has been, they wait for its shares to be cheap. Or whatever is available cheaply, they buy those. Because they think all businesses are cyclic. And with the same thought, we get two types of investors in this investment journey. One of these is called a growth investor, and the other a value investor. Let us analyze this with Zomoto in two aspects.

Before going with these types of psychology we have to do the same homework. So we can make a decision like a professional.

Right now the PE ratio of the stock is not there, but from the price, market cap, and net profit of last year we can calculate EPS. After that, we can calculate PE. First, we calculate outstanding shares to get EPS(Earning per share) then we will calculate PE.

Market cap – 98,849cr, Price 126, Outstanding share = market cap/stock price.

So here OS = 988490000000/126= 7,845,158,730 approx.

EPS= Net profit/Outstanding shares = -886cr / 7,845,158,730 = -1.12

And when EPS came in negative, then what is the meaning of PE ratio calculation.

-

Growth Investment in Zomato :-

Growth investor who always prefers to invest in current market heroes. For this reason, they always have to enter the stock market by paying a premium to enter. But they also carry a calculative risk.

From the above calculation, we know the company’s EPS is Negative. And not only the last year’s income statement was in losses, but the company has been making losses from its beginning. Even its cash flow statement also seems like that. A growth investor always keeps an eye on the profit of the company and calculates the forward profit. and then forwarded PE. As long as the company does not turn into profit, it will be very expensive to buy this stock according to the growth Investment.

2. Value Invest In Zomato :-

Value investors always prefer to buy the best company cheaply. and how does it happen, Means how can you buy the company in a bargain. Yes, it happens, because people are Irrational. Today the battle is going on for the Zomato share market. One bad news is enough to bring this stock to less than half the rate. The value investor is always in search of these kinds of opportunities and they keep cash in hand for many years. In the Zomato case, value investors will use a margin of safety. Which got less than the intrinsic value. Still, you think that investing in Zomato shares it’s on you. But before that, you should go through my example.

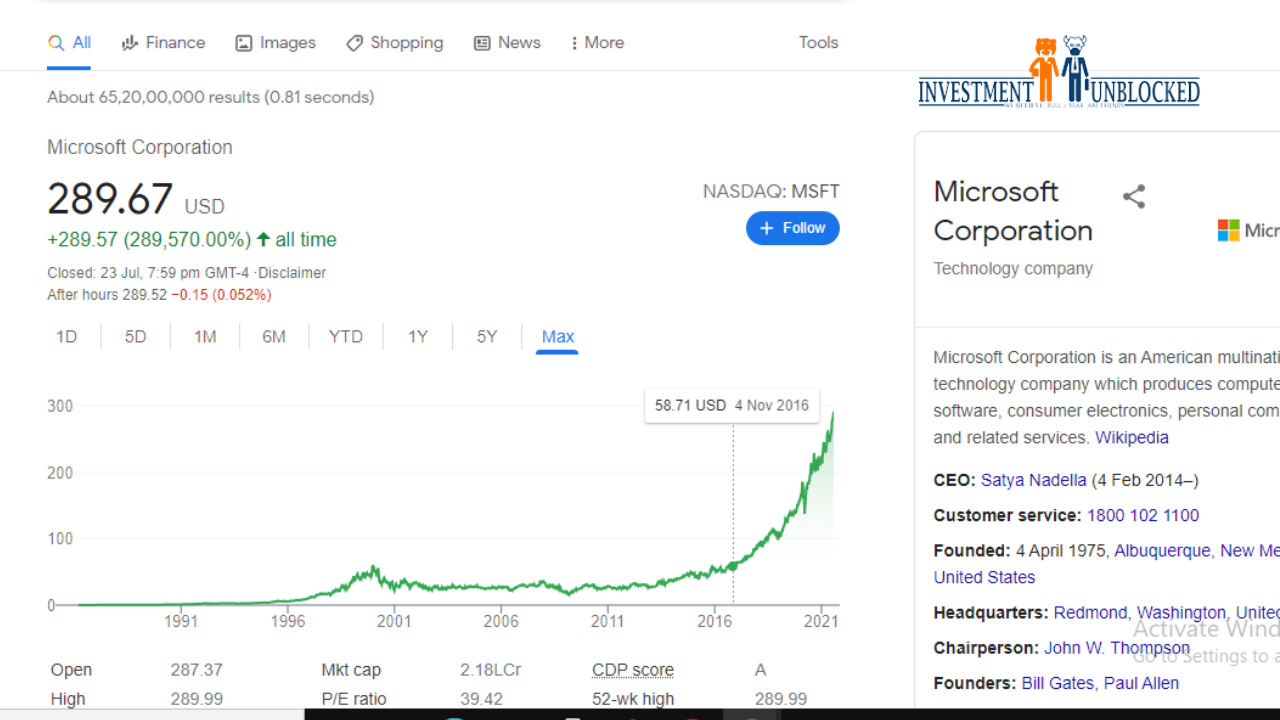

Here is the chart of Microsoft company :-

In 1999, the stock price of Microsoft Company was $58. The dot com crash happened, and then the stock fell from $25 to $22. And guess then when the share price of this company went back to that. That stock touched $58 in 2016.

Took 16 years to come back to that price. And we are talking about a similar company which is one of the biggest companies in the world. And that company was earning profit too, and that too plentifully. But in 1999, due to the irrational investor, the price increased to such a degree that the company’s valuation was many times smaller.

Conclusion :- We learn from the above example: When we bought shares of a profitable company in 1999 market high, it took 16 years to get out of it. Zomato has been making losses for 5 years.

The reasons behind the rise of this share are really so good, or you are becoming irrational like other investors.